The soap opera playing out over raising the US debt ceiling is more politics than reality. Neither political party wants to go into the 2012 elections with responsibility for more red ink on their shoes. The United States is not going to default in our payments of principal and interest on our debt and everyone knows this. That is why the markets have watched this debate with relative calm and baked into the numbers a presumption that some last minute face-saving deal will be done once enough mud had been slung on the face of the opposing party.

But while this may be politics as usual there are instructive lessons about new realities resulting:

- Our Negative view of our Elected Leaders is confirmed. As voters we have tolerated the slovenly behavior of our elected officials and the way they spend our money. The debt ceiling has been raised scores of times in the past without much debate. This time it has become a big deal because while Democrats and Republicans are using it to score points, the rest of us are using it to measure the people we elected by their approval ratings in the polls. Congress scores worse than the President, but his ratings are racing to the bottom to match them.

- It’s the Debt, Stupid. The debate in Washington may be about raising the debt ceiling. The debate on Main Street is about the enormous size of the accumulated debt and the reckless willingness to keep spending. We’ve lost confidence in our leaders because we see them weakening our country, undermining our values, and stealing from our children to play politics.

- President Obama is a Disappointment. We elected Barack Obama because he inspired us to live into our aspirations as a great nation. We demonstrated once again de Toquiville’s 200 year old observation that America has the capacity to reinvent ourselves for the challenges we face. We hoped that the change the President spoke of would lead us there. But he baited and switched us reverting to the most corrosive form of class warfare, entitlement expansion and free-spending liberal instead of the centrist we thought we were choosing. We needed the president to help fix our broken economy but his policies have made it worse. So “Yes We Can” is turning into “Oh, No We Won’t” as the president misread his mandate and no longer seems a good fit for our needs, as the voters might say as we hand him his pink slip.

- Democrats and Republicans are both the same, but the TEA Party member have scruples. This is the ‘pox on both your houses’ lesson we seem to keep relearning. The partisan differences are real and debating them is good but we’re losing confidence in both parties because we have come to believe their debates have more to do with scoring points than principles. While the President and Democrats have trashed the TEA party candidates and tried to discredit those who were elected a funny thing has emerged. The TEA party members are the only group that has remained true to the principles they told us about as candidates. TEA party members in the House have given speaker Boehner fits with their unwillingness to cave into demands for compromise over spending cuts. While their resistance has delayed a settlement of the debt ceiling issue, it fundamentally frames the 2012 election debate around the core issue of spending, overspending and more spending that got us into the debt overhang we face. Thank you!!!!!

- Whose Country is this Anyway! This debate has been a constant reminder of our core values and the choices we face as a nation. We’ve been slackers as citizens coasting along letting our elected representatives get away with bloat, blather, and balderdash on our behalf and with our checkbook. It is like groundhog day only we are watching the movie Network and the line keeps being repeated over and over again:

“We’re mad as hell, and we’re not going to take this anymore.”

The 2012 election is a referendum not only on President Obama and our overspending ways. It is also a referendum on incumbents and most will be found wanting. It won’t be a good year for candidates, we’ve been tricked before with uplifting speeches. We’re looking for real people who share our values and will do what they promise once elected.

Related articles

- Trey Ellis: Debt Ceiling Is Health Care All Over Again (huffingtonpost.com)

- Mitchell Bard: Lesson From the Debt Ceiling Negotiations: The GOP Is Now Run by Far Right Ideologues (huffingtonpost.com)

- Boehner’s two-step plan: Risky politics (capitolhillblue.com)

- The Future Of America, Or Politics As Usual? (trueconservatism115.wordpress.com)

- Armageddon clock ticks down on debt deal (fullcomment.nationalpost.com)

- Boehner delays vote on his debt-ceiling measure (seattlepi.com)

- Death To The Debt Ceiling Negotiations! (huffingtonpost.com)

- Analysis: The politics behind Boehner’s two-step debt hike – Reuters (news.google.com)

- US debt ceiling crisis: Why Republicans won’t compromise | James Antle (guardian.co.uk)

- Tea party to Boehner: Stand firm (capitolhillblue.com)

Gary,

We have to get ahead of the annual spend first, not talk about 10 year spending cut plans from a base spending level that is nearly twice revenue.

In October 2010, I posted a series called Grow, Cut, Print and Default. In that post and a series of follow on posts, I postulated that we would have to do all of Grow, Cut, Print and Default in order to work our way out of our fiscal debauchery.

In it, I pointed out that we will take in $2,318B this year and spend $3,608B. To get to the point where we reduce the deficit, ie spend less than we take in so that we can pay back some of our borrowings, we’re looking for more than $1,290B in annual spending reductions.

This is not some 10 year calculation as our politicians are talking about.

Every spending ‘cut’ package I’ve heard about recently talks of $2-$4 Trillion. That sounds big right? Well, no. It’s over 10 years. $3 Trillion=$3,000 Billion divide by 10 years and annual spending is getting reduced by $300B.

Only another $1 Trillion or $1000 Billion to go of less spending each and every year. That would require a $13 Trillion package.

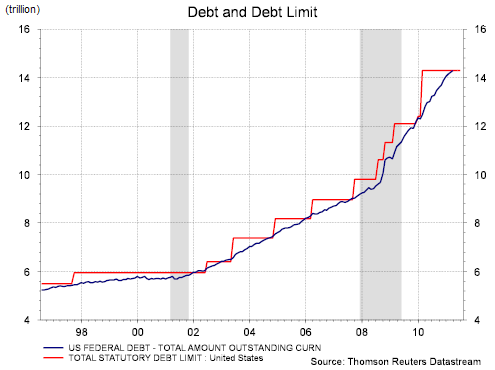

Before we start paying back any of the debt we owe, which is another $14,500B (or $14.5 Trillion) (see the debt clock). If you wanted to be out of debt in 20 years, we’d need to run a surplus of $700B each and every year.

So, if you want to get somewhere, talk about changing federal spending from $3,608B to around $2,750B each year – less if you want to pay down the debt.

Accurate Reality: To get out of this mess, we’ve got to balance annual spending first. This means drastic changes in our expectations of the Federal government and huge cuts in expenditures. What we are seeing today is not even close, despite the media frenzy, to what needs to happen. Assuming we balance the budget, then we should be able to avoid default, provided we also print money, inflate and grow.